There is a completely false narrative that you do not hold bitcoin and that they are an intangible distributed across many machines around the Internet. It is utterly wrong. Individuals hold their own bitcoin. Bitcoin is merely a digital token, and the digital token is never distributed on the blockchain itself. The blockchain acts as a transaction record and log, recording the control and movement of the tokens and allowing the nodes to verify and control the property rights associated with each of the tokens under the rules of the system, which incorporates law.

Property and Bitcoin

Bitcoin is falsely called a distributed or decentralised cryptocurrency because of the ledger. Yet, it presents a misleading understanding and description of Bitcoin. Bitcoin is a peer-to-peer token exchange system that can be used as a form of digital cash. As with all token systems, a token can represent any value and reference any agreed property or item.

Bitcoin is not distributed across a ledger. Bitcoin is held by the individual controlling it, who generally would also but doesn’t need to be the owner. Your bitcoin is not held in the ledger. Your bitcoin is held in your wallet or related application. The ownership of any set of tokens remains with an individual or group (including a company), and is not distributed.

The ledger in Bitcoin is distributed. The ledger is a transaction log, detailing the movement of the reported control of the tokens. An issue with digital property has been that it can be replicated and distributed with little cost. Peer-to-peer copyright violations have been the result of digital files being easily copied. Bitcoin facilitates the transfer of digital tokens over a peer network. It is not the sending to the miners to distribute the tokens; it is the exchange between one peer and another. The ledger was implemented in order to determine the correct version of the file or token. If additional transfers occur, all of them are ignored as the ledger maintains a list of what was seen first.

Bitcoin is a set of individual and indivisible tokens. It does not consist of an account, and they cannot be fractional tokens. Bitcoin is constructed in a manner that does not allow fractions of tokens to be transmitted. People get confused because they see a mere right to transfer. The right to transfer is attached to the ownership of the tokens. But, the ownership of the token is the same as any ownership of a digital right. In some ways, the scenario is analogous to the recent case of Armstrong DLW Gmbh v Winnington Networks Ltd [1], where the courts extended the notion of carbon trading units to be property even though they’re not things in action [2]. Bitcoin is simpler in the sense that it can be taken as a chose (thing) in action if you understand that it is a tokenised form of intangible digital property. More importantly, the peer-to-peer exchange in Bitcoin represents the transfer or exchange.

Every single token in the Bitcoin system has been allocated (issued). It was done so in January 2009 upon the launch of the system. There are no more tokens as the system has been created with a complete issue upon its launch. The tokens created on issue are allocated algorithmically to a set of commercial nodes that act to validate and publish a ledger of the transactions according to a set of defined rules. The rules are published, in part, in the white paper and in code comments associated with the original code. Explanations were given in 2009 and 2010, expanding on the definition. The white paper acts as the equivalent of the software’s EULA [3].

As I explained in the release documents associated with the code, Bitcoin does not use any encryption. Encrypted files can be controlled using a key that may not be distributed. The loss of the key results in an inability to access the file. The same is not true when it comes to digital signatures. Digital signature algorithms do not stop access to files. All transactions in Bitcoin are conducted in clear text.

Peer-to-Peer

Unfortunately, the term peer-to-peer is something that many people do not understand. Peer-to-peer networking has been a concept in computer science for decades. It involves the creation of layered networks, and allows for the differentiation of nodes. In Bitcoin, there are multiple peer-to-peer networks. The ledger acts as a peer network where highly connected commercial systems that are designed to end in data centres compete to earn fees through the validation and transmission of transactions. Such peers I defined in section 5 of the white paper. Such are systems that act commercially, to make a profit validating and logging transactions.

Bitcoin is an electronic cash system that uses a peer-to-peer network to prevent double-spending. It’s completely decentralised with no server or central authority.

Users, on the other hand, were catered by having a limited system referred to as simplified payment verification (SPV). Nodes therein communicate directly. The original client was set to use IP-to-IP connectivity, to allow peers to communicate directly. Each peer exchanges information with another peer whom they are negotiating an exchange with, at which point the communication path does not need a widely distributed network. As I explained in my code, the peer-to-peer network defined in section 5 of my white paper was created to prevent double-spending.

The exchange of tokens is simple. Many digital money systems have been created that allow for a simple exchange of tokens, but all of them have required a single entity to ensure that double-spending cannot occur. It creates a problem as the failure of the entity maintaining the system leads to a complete collapse of the token system. Bitcoin used a distributed peer-to-peer system acting as a network giant node to simulate the central trusted intermediary without losing out to the typical fragility of a single entity. All companies eventually fail. History has demonstrated it. Bitcoin allows nodes to come and go in a loosely structured mutualised association as it allows any member or node to fail without impacting the system. The prime failure of all PKI-based systems lies in the fragility caused when a single entity is compromised or enters bankruptcy. Bitcoin removes such fragility.

Bitcoin does not replace banking or banks. Bitcoin presents not a political statement, and the false assertion that code is law has long been discredited [4].

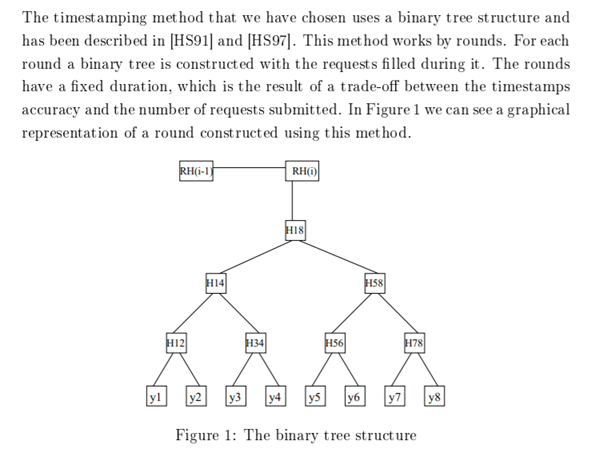

The idea that blockchain-based systems such as Bitcoin or even Ethereum are decentralised and thus outside of the scope of law is purely the manifestation of con artists and criminals. Bitcoin or any derivative system do not decentralise ownership. The ownership is not defined through the ledger. Property rights in Bitcoin exist because of law. The ledger is merely a time-ordering and logging system. When I created Bitcoin, I took the system associated with the second reference of the white paper, incorporating the systems that had led to it dating from 1991 on, and changed it to form an analogous time-ordering system that was more resilient than the one that had been presented by Massias et al [5].

The image above stems from research dating back to 1991. The authors of the paper referenced in the Bitcoin white paper created what everyone sees as the concept of the blockchain. The distinction is that they did not believe it would be possible to form a distributed network of validation nodes. Consequently, they fell back to a single trusted entity and sought to minimise risk by publishing a set of rounds, or what we would call blocks now, on a daily basis in a newspaper. It was only the block header that was required to be published. The chain of headers represents the overall structure within the blockchain. The distinction in Bitcoin comes with a competitive system that is used to replace a single PKI-based timestamp authority with a competitive group.

The competitive group is structured as a parallelised quorum. All information is maintained publicly and auditable, allowing a defecting or attacking system to be detected quickly. Once detected, the honest nodes can isolate the attacker and use computer crime legislation including the US federal CFAA laws to ensure that the offending node is brought to justice. Even if an attacker gains temporary access to the network, the attacker will not have any rights under law.

In the paper, users seek to timestamp documents. Users in the Bitcoin system seek to have transactions notarised and logged. The Bitcoin nodes defined in section 5 of the white paper act as a distributed notary service. In ordering transactions, we can reject any attempt to use the same information twice. Here lies an important property as Bitcoin allows us to remove the notion of artificial scarcity that many have argued is the reason for intellectual property law. Property rights are designed to enable controlling access to scarce resources. Authors such as Harris [6] have gone as far as saying that intellectual property rights are designed to create artificial scarcity in a manner that mirrors the rights to intangible objects.

Property

The word ‘property’ reflects its semantically correct root by identifying the condition of a particular resource as being ‘proper’ to a particular person [7].

Bitcoin is a system that allows intangible property to be assigned individually or to a particular person. As with all property, the transfer of bitcoin may be invalid, and theft remains possible. As with tangible property, bitcoin that has been stolen or otherwise illegally transferred is now taken out of the control of the true owner.

Fox [7] described the manner in which a transaction and token within bitcoin differs from a pure intangible. Even though represented digitally, the existence of a single valid token at any point in time allows bitcoin to be treated as a tangible document which is capable of being possessed. As such:

The presumption of title from possession does, however, have some limited relevance when the chose in action is a documentary intangible, such as a share warrant transferable by simple delivery, a bill of exchange payable to bearer, or a bearer bond. If, for instance, P1, the original owner of a share warrant, were to have the warrant stolen from him by P2, then P2’s possession of the warrant would confer on him a relative title to the document as against any third party, P3, who tried to interfere with his possession. As between P1 and P2, however, P1’s subsisting legal ownership would give him the stronger title. P1’s ownership of the warrant document would continue until the person in possession negotiated it to a bona fide purchaser without notice of the possessor’s defect in title. The basic distinction is between actions where the claimant depends on possession of the tangible document and those where he is suing on the intangible claim embodied in the document.

Bitcoin does not exist nebulously in a distributed global ledger. It exists as individual tokens. As such, the tokens that form the basis of any transaction in Bitcoin are analogous to what Prof Goode has defined as documentary intangibles [8].

If we define the system to default to assert that the first transaction that is recorded is the only one that maintains property rights, we can create a digital token system that allows individuals to exchange value, incorporating digital systems that are not encrypted and can be easily copied, and associate the rights of ownership with a single copy. It is not the representation that is scarce within Bitcoin, but the nature of adding a form of digital rivalry changes the form of intangible property that would normally be non-rivalrous in nature to mirror the form of tangible property. In British Tobacco UK Ltd v Health Secretary [9], it has been argued that:

One of the key features of intellectual property, unlike corporeal property, is that infringement of intellectual property rights does not exhaust the property itself. If A takes possession of B’s land, or borrows his car, B is deprived of the use of his land or his car, at least temporarily. But if A works B’s invention, that does not prevent [B] from working it too, although it may affect the profitability of exploiting it. Likewise if A marks his goods with a sign that is confusingly similar to B’s registered trade mark, that will not prevent B from continuing to use his own registered mark. In addition, registered trade marks, like other intellectual property rights but unlike land or chattels, do not exist in nature. They are the products of legislative intervention.

Before Bitcoin, intellectual property was maintained in a manner where it was artificially scarce. The creation of Bitcoin presented the means necessary for a technical solution to the artificial-scarcity problem. Although the particular transactions may be copied, and even the token at a point in time is subject to copying, the res or rights that provide and define ownership can now be separated such that digital items can be treated as if they were tangible property.

References and Notes

[1] [2012] EWHC 10 (Ch); [2013] Ch 156.

[2] Ibid. at para 61.

[3] End-user license agreement.

[4] Tim Wu: When Code Isn’t Law. 89 Va. L. Rev. 679 (2003).

Available at: https://scholarship.law.columbia.edu/faculty_scholarship/844.

[5] Massias, H. Avila, X. S. Quisquater, J.-J.: Design of a Secure Timestamping Service with Minimal Trust Requirements. In: 20th Symposium on Information Theory in the Benelux, May 1999.

[6] Harris, J.W.: Property and Justice. pp 12, 24 (1996).

[7] Gray, K. Gray, S. F.: THE IDEA OF PROPERTY IN LAND. In: Susan Bright and John K Dewar (eds), Land Law: Themes and Perspectives, 15–51. Oxford University Press (1998).

[8] Fox, D.: Relativity of title at law and in equity. 65 C.L.G. 330, 362 (2006). Available at: https://doi.org/10.1017/S0008197306007148.

[9] McKendrick, E.: Goode on Commercial Law. paras 2.56–2.58. 5th Edition (2016).

[10] [2016] EWCA Civ 1182; [2017] 3 W.L.R. 225, [31].