There is an overwhelming amount of false information around Bitcoin and, in particular, on the topic of privacy or pseudonymous transfer. Bitcoin is anything but anonymous. Anonymity requires that individuals do not know anything about the other party that they’re dealing with. Privacy, on the other hand, allows people to interact and keep identities away from the public. In discussions and posts such as the enclosed, we see the false dichotomy presented as a strawman. Bitcoin or any blockchain is completely irrelevant to the story in the form they are talking about. The question “Will Blockchain Bring Freedom or Tyranny to China?” is misplaced.

The existence of databases and ledgers precedes Bitcoin. Interestingly enough, distributed databases have existed for decades. The distributed nature of Bitcoin is such that it allows unrelated entities to compete in maintaining the ledger. As such, if a single entity becomes bankrupt or goes out of business for some other reason, it is unnecessary to be concerned about the state of the ledger. In other words, even if individual parties involved in the management of the system suffer a disaster or catastrophic loss, Bitcoin continues to operate.

Central systems continue to operate as long as the primary body does not disappear. In the case of governments, there is no concern. Unless the government currency disappears, or the government is replaced by another, a centrally controlled system within a single government jurisdiction can continue to exist.

The problem with central bank currencies is one of seigniorage and alterations in the money supply. Where we are talking about a fixed government-based stable coin, the existence of a blockchain becomes irrelevant. It is simpler to use a distributed database.

Bitcoin is not anonymous. And whether we’re talking about Plato’s ‘Ring of Gyges’ or the revisiting story of ‘The Invisible Man’ by HG Wells, it has been clear throughout human history that no man remains moral without his actions being monitored and viewed. The same applies to both people and the institutions we create. Governments require transparency to remain honest and aligned with the needs of the people they represent.

Bitcoin is a transparent system that allows monetary tracing. It is not possible to create a blockchain-based system that is anonymous. It is importantly so, because anonymity helps breed corruption.

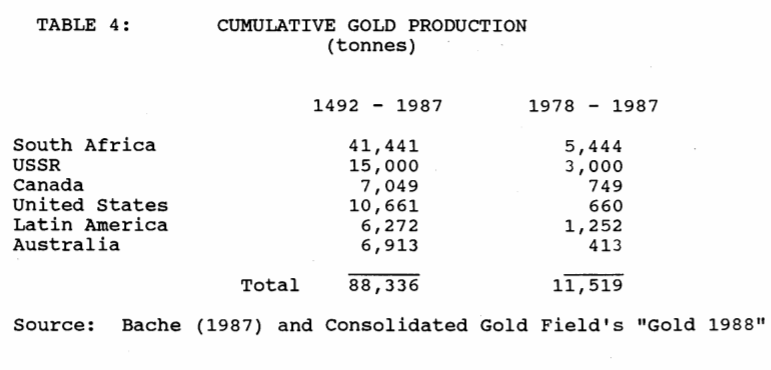

In the YouTube video, the presenter says that gold does not increase in supply by more than 2% in any year. Which is false. The overall gold supply has not been steady. Some years have seen 8% changes to the total supply. In particular, the discovery and production of gold in South Africa following 1886 radically changed the distribution of the global gold supply; the introduction of the South African gold supplies in the period following 1886 both radically altered the distribution of gold globally and drastically changed the total available supply. Between 1980 and 1987, the production of gold in the US increased by 407%. Contrary to the touted position that the gold supply was even, gold has in fact been incredibly volatile in supply and demand.

Bitcoin was not designed to replicate gold. The false story mirrors what the Bitcoin Core team wishes to promote, which radically differs from the goals that came with the white paper. Bitcoin is designed to be a peer-to-peer electronic cash system. Bitcoin, in particular, was designed to allow for micropayments across the Internet and small casual transactions.

The entire premise of the video treats Bitcoin as a strawman aligned to gold, which stands in glaring contrast to the actual aims of Bitcoin. To cover some of the numerous errors presented in the video, let us address and clarify some of the most egregious ones:

- Bitcoin can be frozen.

- Bitcoin does not compete with banks.

- Bitcoin is not designed to act against or outside of government and law.

- Bitcoin Core or BTC is not Bitcoin, and is barely related to the original code.

- Bitcoin does not separate money from state.

Bitcoin is incredibly simple to freeze, seize, and for governments to intercept. The concept that Bitcoin was James A Donald’s “decentralised code-is-law” system that would allow crime and the exchange of goods and services in black markets is simply false.

In 2008, it was James Donald who argued with me in saying, “But the way I understand your proposal, it does not seem to scale to the required size.”

Where he argued that Bitcoin required monetary value and a very large network, he failed to understand that Bitcoin was not designed to be a system operating outside of government control. It was always designed to act within law. Bitcoin does not require hundreds of millions of people all interacting; I created simplified payment verification (SPV), allowing users to just be users. The problem here, of course, is that people like James Donald were not seeking a system that operated within the legal system. They dream of a system that acts outside of government and legislative control. The difficulty in creating Bitcoin lay in implementing a system that could not be subverted to act outside of legal and legislative controls but instead operate across international jurisdictional lines, provide monetary tracing, and continue without moving towards the anonymous monetary system that we have seen develop with all digital currencies prior to Bitcoin.

James Donald started the false narrative that we see commonly promoted today:

If a small number of entities are issuing new coins, this is more resistant to state attack that with a single issuer, but the government regularly attacks financial networks, with the financial collapse ensuing from the most recent attack still under way as I write this.

Ever since I released Bitcoin, people have been seeking to alter it and make it something different. They have sought Tim May’s anarchist system that followed other, failed attempts at digital money. All of them have failed as people sought to become anonymous rather than maintain privacy. It is the same people who have failed to understand that money works in the real world, that there is no such thing as a digital world outside of the control of law. And it is the same people who fail to understand that they are the minority, that the majority of people seek the protection of law.

The concept held by a number of anarchists who fail to think or at least are disingenuous and hypocritical in their ideas that Bitcoin acts outside the government and is a threat is one of the most asinine cult-like beliefs of the century. Most importantly, it is incredibly simple to utterly discredit in moments.

Today, three court orders in three countries would lead to the immediate seizure or freezing of any Bitcoin address. For those who have not committed a crime, it is unlikely that such an order would be enacted across Europe, China, and the USA — the four-day average has been around 70% coverage, with a single court order being enforced with a reciprocal order in a second country. Extending it to a European jurisdiction will incorporate the exchanges and the majority of global traffic. If an individual country was to fork Bitcoin, or if, say, Bitcoin.com decided to ignore the court orders as they had not been enforced in Japan (which may occur, but increases the cost of enforcement and is simply unnecessary), then they will end up with a new cryptocurrency that is only viable in the respective country and does not interact with Bitcoin. In fact, any use of the new currency would breach legal conditions within the USA, China, and Europe, whereby any exchange accepting it would be criminalised.

The concept that Bitcoin will just create a black market if government tries to stop it is utterly asinine. Bitcoin can only act, at any scale, when it is acting within the law. Bitcoin was not shut down by China or Russia or the USA or anywhere else globally, because at no point did it ever break the law. There are individuals who have broken the law using Bitcoin, which presents a completely different scenario.

Back to the Original Argument

Bitcoin is not anonymous, but little does it matter when we’re talking about China. The mere possession of an illegal asset can be controlled by making the asset a criminal item, which would instantly remove the ability to exchange the asset at any scale — making it vulnerable to government seizure. The people commenting on Bitcoin fail to understand the nature of the system within Bitcoin. Mostly, though, they fail to understand that Bitcoin is irrelevant when talking about the ability of a government to monitor its own citizens in a country such as China. It is not Bitcoin that adds surveillance, it is the government, and it will do so with or without Bitcoin. In fact, the blockchain adds transparency, allowing both the Chinese government and other governments and even human rights activists to start monitoring how the system is monitored. Transparency does not create tyranny; anonymity and shade do. It is the fact that everything is public that allows Bitcoin to not be controlled by tyrannical governments.