Anarchist anti-government and anti-law promoters of Bitcoin will tell you that if you don’t have your keys, you don’t have your bitcoin. Unfortunately for them, keys are not law. Private keys make access to funds difficult. They don’t prove ownership of property rights, which never was the intention of Bitcoin. I’ve been writing on electronic contracts in matters of law and code for nearly 20 years now, and one thing I’ve always noticed is that the code side of the argument always says that non-repudiation will be possible. Let me make it clear: non-repudiation cannot exist in law.

It does not matter what you do and code. It does not matter what you do in mathematics. Non-repudiation does not exist. The law includes aspects of error, intoxication, theft, duress, and many more things that preclude the ability to stop people repudiating an action. It, by nature, includes signing a contract with a digital key. And it includes, as a subset, transferring bitcoin or having access to a key.

Going back to 2008, people have been trying to change Bitcoin to incorporate the pipe dream of non-repudiation. They see a system that acts outside of the real world. The reality is, Bitcoin will never act outside of the real world. Nothing will. Every single thing that exists will be tied to the real world in some way, and if you don’t like it, then you’re going to have to learn to live with it.

Let’s simplify the scenario for people.

You can get a digital key that allows you to unlock a home or a car or even to make a device run. Losing the key may cost you money and require that someone come in and ‘rekey’ the house or the car, but it does not change property rights. If someone steals your private key that allows accessing and driving your car, he doesn’t own your car, and through actions of tracing and recovery, you are able to use the legal system to recover the asset.

Bitcoin is no different.

The error made by people who look at Bitcoin and say that it is a code-based rather than a law-based system lies in considering the economic costs of recovery, which they don’t understand isn’t a legal aspect, but rather involves a decision-based choice of the owner of the property. Bitcoin is recoverable. When in 2008, 2009, and 2010 I explained how Bitcoin would end in server farms and was not the anarchist system where everyone would run a node, nor could it be, the point I was getting at is that a professional corporate system comes with costs and benefits.

One of them is recovery.

There is an old aspect of law known as tracing, which allows for the recovery of assets. Bitcoin miners and exchanges of corporations both forming reciprocal agreements and implementing the international recovery of assets may endure a long and expensive process, but it is one that is well-defined within law.

The same misconception was common with homeowners who thought that the loss of an original promissory note would stop the mortgage holder or lender from enforcing the note. A promissory note is written evidence of a debt owed by one party to another and the terms of the repayment. In some ways, Bitcoin is a record that shows evidence in a ledger of the transfer of an asset.

With numerous tracing and recovery cases that have been enacted on intangible properties such as carbon credits, there is nothing particularly difficult in a court issuing an order to recover bitcoin or any other crypto asset. Bitcoin miners are analogous in some ways to a distributed clearinghouse, and may even be analogised along the lines of the US Federal Reserve — the difference being that miners may come and go by choice. The value of bitcoin requires that it is able to be transferred for other assets. The push to make Bitcoin more private and to create confidential transactions that hide the source and destination of a transfer changes it from Bitcoin to some other system and, as it happened with all of the ones that have come and gone before, removes the legal aspect of the coin and hence all value.

More than anything else, the biggest difference in Bitcoin with the ledger has been the introduction of a legal process and the alignment to existing laws. When I created Bitcoin, I created something that would work within the law. That is the difference: other digital currencies have sought to act outside the law, and have chased monetary value in illicit and illegal activity.

Tracing

Mondex and DigiCash have both been involved in tracing, and more recently, Liberty Reserve US Dollars and Euros were involved in tracing activity. For the most part in the UK, tracing law relies on FIFO or first in first out. When a coin is mixed, it can be recovered using a principal of recovery on the order that they are inputted. In law, fungibility differs from the way the term is used in general parlance and even economics. Money is fungible when it is received without notice of fault for valid exchange of goods and services. A gift can never be fungible. Ownership and possession are not the same thing.

The concept that is counted consistently of “no keys, not your bitcoin” is meaningless drivel.

Very soon, you’re going to see just how foolish this idea is. A decade ago, I didn’t have the power or the resources to step in and do what is necessary to steward Bitcoin to where it needs to be. I do now. For those like James Donald who believe that they can create a system that is censorship resistant as he used to say, one that allows them to implement all of their stupid wacky ideas, you’re very likely to see why I covered something off in my 2008 thesis on payment processes and intermediaries.

Peer-to-peer processing networks have aided the growth of auction intermediaries such as eBay.[1] Payment card providers, P2P systems, and other entities that act as a mechanism to facilitate commercial transactions[2] also have the capability to stop illicit transactions and act as revelatory enforcement points. A commercial site distributing child pornography from Nigeria cannot be run profitably without an economical method of receiving consideration. If the site operators cannot reliably receive payment, they will quickly shut down. As the financial gatekeepers, payment intermediaries can be used to prevent illicit activity over the Internet. Either through proactive actions or upon the receipt of court orders and Internet payment intermediary could be used as an aid to curtail undesirable activities occurring across the Internet.

There’s a simple reason why James wanted untraceable payment systems: he supports freedom through child pornography and paedophilia. I’m not the first person to write up the topic and the ills that have been promoted by people falsely claiming Bitcoin is government resistant.

Jim likes to argue that freedom of speech includes child pornography. The truth is that the same people are simply criminals seeking to create a system outside of government control for as long as they can.

The Lightning Network is not how Bitcoin was designed. The same overlay network designed to lose logs and records dates to before I launched Bitcoin in 2008. It is the proposal of cypherpunks, and radically differs from the concept of Bitcoin. It is the erroneous idea and mistaken view of law that has been promoted using the flawed ideas of Nick Szabo. I say flawed because there is very little in them of value and the legal scholarship is truly abysmal.

Freezing Injunctions and Third Parties

A third party (such as a miner, exchange, or wallet provider) which knowingly assists in the disposal of the assets, including bitcoin and other ‘cryptocurrencies,’ whilst subject to the freezing order, may be subject to proceedings for contempt of court and held liable to a fine, the seizure of assets, or imprisonment for up to two years.

Potential Liabilities of Third Parties such as Miners or Exchanges

A miner or another third party which acts to process a Bitcoin transaction knowing it to be covered by the terms of the freezing order and thus willingly assisting in the breach of such an order is liable for contempt of court, punishable by fine of assets or imprisonment. The contempt could constitute an unlawful means on the basis of which a tortuous claim for conspiracy could be further brought.

The Bitcoin alert system allowed a court to issue a freezing order with minimal interference to the system. The ability to stop processing individual addresses was being developed in 2010 and, as such, is provably part of the Bitcoin infrastructure, which may be placed as a requirement against miners. Unfortunately for many at the time, it was not what they saw to be ‘Bitcoin.’ Then, Bitcoin is my creation, and it was never for the ‘community’ to decide.

If you want something other than Bitcoin — then make it as bit gold.

Bitcoin miners and exchanges should take the notification of a freezing order extremely seriously. A failure to comply with a freezing order exposes a Bitcoin miner to the risk of contempt of court, which could lead to a fine, imprisonment of its employees, and the seizure of its assets.

Sequestration

A writs of sequestration can be issued under the context of a penalty imposed for contempt of court or in relation to breach of a judgement, order, or undertaking. The power of the court provides a collection of specific procedural rules that in the UK are incorporated in CPR 81 (elating to writs of sequestration). They enable the property of the defendant to be seized and retained until they comply with their obligations and clear their contempt.

In the context of Bitcoin miners, procedural rules would include the ability to issue orders against the miner allocating property to the state. That is, where a judgement has been obtained, say for the seizure of bitcoin associated with a drug deal or people smuggling, for instance, if the miners decide not to block transactions associated with the same bitcoin or even reallocate them under preset of crime legislation to the government, the Bitcoin miners will be in contempt of court.

Actions known as worldwide freezing orders exist under financial law. Judgements can be issued in multiple jurisdictions including the UK, Europe, China, and the USA simultaneously or close to simultaneously. Before the issue of such an order, an injunction can be put in place. Unlike James Donald, I never feared the government when it came to Bitcoin, because I made a system that works within the law. Shortly, people are going to start to notice the difference between what I created and what groups like Bitcoin Core are attempting to do. The reality is, Bitcoin always moves toward specialised data centres. I knew it would the case when I created Bitcoin, and I discussed the scenario in depth with many people. Unfortunately, they have the flawed idea that Bitcoin can ever run as a distributed system where every single user is equal. It cannot, and in fact, to do anything along those lines requires a system radically different from Bitcoin.

Where the contemnor (such as a miner) is a company, a writ of sequestration may be issued against the property of any director or other officer of the company (CPR 81.20(3)).

Such an order may be made in respect of assets that are outside the jurisdiction (Touton Far East PTE Ltd v Shri Lal Mahal Ltd and others [2017] EWHC 621 (Comm)) applying Vis Trading Co Ltd v Nazarov [2015] EWHC 3327 (QB).

Provisions of the Supreme People’s Court (25th June, 2018) have been issued on Several Issues Regarding the Establishment of International Commercial Courts. They detail the functions and powers of the two new courts which shall be established in Shenzhen and Xi’An, and follow the move to increase infrastructure connectivity and the development of the Belt and Road initiative. As an enabling technology, Bitcoin will be able to be adjudicated within such regions. Consequently, a UK or European judgement can be enforced in China and the USA from an order in the UK.

Many of the early cypherpunks wanted a system acting outside of government. Because of the false writings of many early Bitcoiners, there has been the narrative that government cannot interact with the blockchain. Which is wrong. It is incredibly erroneous. Databases have been created for decades based on write once read many (WORM) media. There are settings in Oracle that allow immutability. To change such a system, you simply update the system. The flaw here lies in the fact that code is subservient to law.

All code operates in association with the real world.

In the real world, there is a person at the end of every keyboard. And courts can order people to do acts. Bitcoin cannot work anonymously. It was designed this way. It’s what took me so long to make it work. And because there is no way to run Bitcoin without the system ending on specialised servers, in data centres, there is no way to stop the interaction of government with the system. As noted, a corporate miner who chooses to act in violation of a court order will be in contempt. Simply put, the miners that invest hundreds of millions of dollars and then thumb their nose at government will quickly find the government taking their multi-hundred million-dollar investment away from them. It is a system that becomes more and more aligned with the law over time.

You see, the survival of the fittest miner comes with the one that stays within the law. Every time a miner is fined, every time a miner breaches a worldwide freezing order and axe to process a block including a transaction that other miners will reject, they will lose money, and over time, they will go out of business. The system is designed so that those who choose to support criminals will slowly and inevitably be driven away from the market. Such is the Bitcoin that I created in 2008 and released in 2009.

Luckily, we are now at the point where it no longer matters what the hat brigade tout as their false version of Bitcoin.

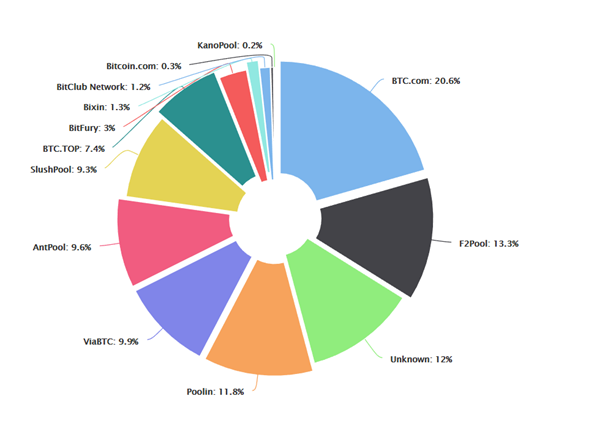

At the time of writing, 74.1% of the BTC hash rate is located within the jurisdiction of China. Many of the major exchanges and places where people store bitcoin are located in the USA. Consequently, it would be strategic to seek multiple freezing orders in the UK, China, and the USA for any significant bitcoin holding that is sought.

As governments and regulators start to awaken and flex, we should see the false narrative that has come to infect Bitcoin (that it is a censorship-proof system outside the law) fall away. James A. Donald may have started such an attack on Bitcoin in order to maintain his illicit activities, but others including Amir Taaki (AKA Genjix and one of the founding members of the Syrian Electronic Army) have taken it to an extreme using Bitcoin to fund terrorism through the trafficking of minors.

But, Bitcoin is an immutable evidence trail. Unlike e-gold and eCash, Bitcoin leaves an audit trail. It is why it will survive where other digital currencies have failed — it works within law.