My personal bitcoin and the ones owned by the company were two different things. The ones that were being used by the company were not brought into Australia.

The system lodged everything as rights to bitcoin. There is a reason for doing so; we didn’t know about the tax certainty of bitcoin at the time. As such, they were being managed overseas. We transferred the rights to bitcoin. In such a way, we could instruct someone else to make a payment without having the uncertainties associated with Bitcoin under the Australian tax law at the time.

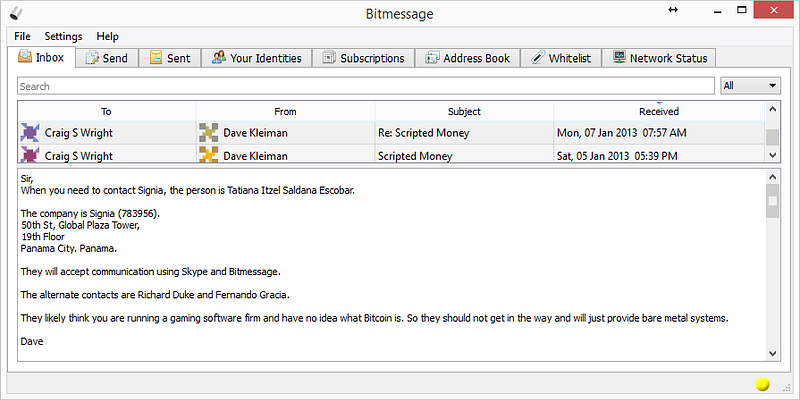

In a way, it would be the equivalent of having bitcoin on an exchange. When you have rights to bitcoin that are held on a custodial wallet with an exchange, you have the right to funds but not the funds themselves. We used a law firm in Panama for such a process. It was far from being ideal, but given that we could not guarantee regulatory certainty, it was all we could do. The process worked by sending them a letter of communication over Bitmessage, and they would make a payment.

When I started the process in 2011, the total value of Bitcoin was very low.

What did happen was the same that happened with many other exchanges. When we started going through the audit process in Australia, we found it was difficult to get information. It cost a lot of time and effort to get people to respond.

I was able to get controlled assets paid for, which included computers and software. Money became difficult in harder forms as the price of bitcoin went up. It should be easier, of course, but you never know how much you actually have of an asset that you don’t directly control. I locked my personally held bitcoin into an account that was fairly well-controlled. It still is. There are ways of protecting files and storing them. The company, though, was different.

One thing that people don’t know is that I ended up losing a lot of bitcoin through rights which went missing. In 2015, we still had bitcoin in overseas holdings, and I knew the amount through the accounting system, but accessing them was difficult. The biggest problem came when a number of people involved in Panama vanished. No, I did not lose other people’s bitcoin… I had a good amount of mine vanish.

At the time, we had remaining rights to a little over 100,000 bitcoin.

None of them were early bitcoin that I had mined.

I never brought the money they earned in casino software back into Australia. In 2011, I had around US$30 million in Caribbean bank accounts. They were all in structured trusts and companies. If I had brought the money back to Australia to use it as cash, I would have ended up paying tax directly. The painful process that I engaged in was having a law firm in Panama buy bitcoin for me.

It was held overseas, and in 2011 and 2012, we went through the first bubble and pop. So I went through a slight gain, then a loss, then later a gain again.

I wanted access to core banking source code.

I needed the code more than anything else to understand some of the systems that I wanted to build. The only way I could get the knowledge was to get access to a commercial core banking platform. It was the reason we did the Rubik/Temenos deal, too. It’s one thing to have a set of source code, but you also need to learn how it’s installed, managed, and run. Additionally, I managed to get access to a full suite of SCADA control software and did a lot of research into the exact effects of Bitcoin over time as it scales. I knew that it stopped being a uniform system and became a dynamic system, but I needed to understand the inflection points of my system better. To take it from Alpha and Beta into a working system required such understanding.

The 1,300 or so white papers that we have created and which are all going to form multiple patents would not exist, if I hadn’t done so.

It becomes a different world when you have money.

When I was younger, I would never have imagined giving the right to transact tens of millions of dollars of your own money to another person. But even with Bitcoin, it is how the world works. The problem comes when you have your money in places like Panama. When companies disappear, so do funds.

In late 2015, the people who ran the fund I was dealing with vanished from the face of the earth. It’s not too hard to vanish with 100,000 bitcoin in South America. So no, I don’t like talking about any of it. I don’t think anyone would. That is why I got help from Stefan. Stefan’s background lies in dealing with difficult accounting scenarios. If I hadn’t, I would still be trying to dig my way through accounting paperwork and would not have gotten any research done at all.

The part that hurts most is that I know it was partly an inside job. Some of the people that used to work for me had contacts in the finance industry, but also, part of the same group had access to the company file shares. It wasn’t even until the Kleiman case that we started to notice some of the things that had been happening. I’m still embarrassed to say that there was a backdoor in the system I owned nearly 2 years after a staff member had no longer been working for me. More than 15 months after we had approached lawyers to send a cease and desist notice and have certain people injuncted from taking the software they had been working on, selling it, and seeking angel capital based on it, we still had backdoors into the system that an ex-staff member had left.

So that’s my biggest failing.

It was my hubris which led to the loss.

But it taught me a valuable lesson. It taught me an incredibly expensive lesson, but a valuable one. I learned the lesson of not having control of your system. Not holding your keys. It’s wrong, it misses the point. In any large organisation, shareholders are not going to be managing funds, nor are directors. Money flows throughout the organisation.

The lesson I learnt was about audit and control. I’ve been an auditor in the past, so I should have known better. Especially with my own money. Then again, if you’re handling other people’s money, you also have a duty of care.

Things like Bitfinex, Tether, and Binance are just digital rights.

When you have Tether or some so-called asset sitting in one of the shadier B– exchanges, then you don’t own the asset; you own the rights to it. We’ve seen the same thing I’ve experienced over and over: an exchange gets hacked, an embezzlement occurs, and people disappear. In all of the scenarios, what really happens is that other people’s money goes missing. I’ve been there. I don’t want to see it happen to others.

I really don’t want to see the scenarios I went through in the early days of Bitcoin continue. There won’t be an ETF or anything else involving institutional money anytime soon because we have a system of wash trading, embezzlement, and fraud.

When I instructed the members of the company who controlled a trust to exchange US$30 million into bitcoin so that I could hopefully transact back in 2011, it resulted in the price hitting an all-time high and then crashing again even further. It wasn’t until 2012 that the value of my holdings approached the point where it had been the year before (which took 15-16 months actually).

I thought I was being particularly clever when I set up the structure I had in Panama — which part was fine; the problem occurred later, when the price went up further. Law firms in places like Panama handle US$30 million routinely. It was in 2012 that the problem really occurred. It was when I wanted to bring things back to be used in Australia. To me, the problem was the sudden and massive increase in price while still not being able to take direct control.

My assets increased through all of what was happening, and it end up becoming one of the problems. I ended up with more money than I had started with, but so did a lot of other people who shouldn’t have.

The funny thing is that people want to say that I’m defrauding somebody. Yet I’m not the one asking for money, and I’m not the one asking you to hold funds so that another can get out with a profit, and I’m not the person who runs an exchange that acts as an illegal bucket shop and operates custodial funds that are exchanged without full anti-money laundering compliance and without the traceability that is inherent in money.

If I was to create some useless shitcoin or even to alter Bitcoin to incorporate aspects that allow criminals to operate and that help the funding of organised crime (as it happened with BTC, Monero, BCH, and others), they would laud me as a saviour. But I don’t. I want to create money that is traceable.

It is true, I don’t want an anonymous coin. When I created Bitcoin, I didn’t create something to be anonymous. I wanted private, which is not true anonymity. When you are operating as I was, a sudden increase in price becomes dangerous. If you can imagine an asset that was worth US$20 becoming worth US$200 and imagine starting with a US$30 million investment, you end up with something that is easy to take when it’s tied to just rights without traceability. If you imagine a system based on Monero, imagine businesses trying to operate. My US$30 million became US$300 million. And I wasn’t ready for it.

I’m actually still not ready for it, but it’s here, and such is life. I’m not ready to take the mantle of my creation and try to teach people how it can be used to create honest global money. To be honest, it scares me shitless even now.

Now imagine that the US$30 million investment had increased in value over such time, even as you’re spending it. I thought when I bought a US$6 million computer and paid for the hosting that I’d bought something immense. I couldn’t imagine it at the time, even as I was living it. Later, I made a deal that was worth more than US$15 million a year for computer services. The results of all of that will be known soon. I started discussing them with people already.

I still don’t hold my money. The difference now is that I have better controls. There is no way anyone can obtain anything from the trust without the conditions I have set to be enforced — not even if I wanted someone to.

I don’t like the fact that I’ve had people steal from me. But it has taught me a valuable lesson. An expensive lesson, but a lesson nonetheless. What I see now is that many others are facing the same lesson.

If Bitcoin isn’t used, it has no value. Not that it’s digital gold; there is already digital gold. Gold certificates have been tradable online for decades. Digital gold works as real gold. The truth of the matter is that digital gold is only valuable as a digital money-laundering asset. Bitcoin is only valuable when it is used fundamentally as a ledger and as cash.

If somebody is telling you that bitcoin will go to the moon, he is scamming you.

Bitcoin will have value when it is used. When it’s exchanged, when it becomes a ledger records are stored on, when it acts to secure networks by recording digital information and logs that cannot be deleted by hackers, but most of all, when it’s exchanged as cash.

I own a lot of bitcoin. My trust has been set up for the benefit of others to hold bitcoin for purposes set now and in the future.

I have more patents on blockchain technology and in particular Bitcoin than any other person alive. Yet I’m not going to tell you that it’s going to moon.Those who are calling me a fraud, those who are doing the best to manipulate data that I used to own, alter records further, disseminate bits of documents and other orders, and even help those who took the remaining money that I had and continue to swap it into Monero and Zcash; you could argue that they are committing frauds.

Those who want to take the original idea of Bitcoin and pass it off as something else without acknowledging the fact that they have altered it radically and are continuing to do so, they are committing fraud. Those people who tell you that bitcoin will go up just because bitcoin will go up are engaged in a Ponzi scheme where they pump the price using wash trades and illegal procedures. They are frauds.

You see, the thing with a fraud is that you have to make money through the actions that you’re taking. The simple answer lies in finding where the money is likely to go and who benefits — not in building a system, but in telling you that the system is going to go through the roof. Which in itself is a crime.Unlicensed financial manipulation and the use of social media to manipulate people into buying are a form of fraud. So when we step outside of 1984 and have people who fear going to court calling out fraud, you can start to see where the problem lies.

I want a system that is honest.

One of my favourite authors is Lewis D. Brandeis. He is the author of Other people’s money and how the bankers use it.

“If you would only recognize that life is hard, things would be so much easier for you.” ― Louis D. Brandeis

When people understand that unaudited want-to-be criminal organisations that act merely as a bucket-shop exchange to allow the laundering of money posing as gambling are not use, they may start to understand that Bitcoin is more. I didn’t create Bitcoin for it to be a new form of money laundering, and I didn’t create it to be anonymous for the same reason. When people tell you that my creation is there to democratise finance, what they are really saying is that they want a system without controls and regulations. They want a system where the strong can take from the weak and the criminal aspects of society can take away from the rest of us.

I’m not working on creating Bitcoin to make myself more money. I’m working on Bitcoin to create a system that tilts the favour towards honest enterprise and hold both governments and corporations to account. A system that allows people to control their own money, not to gamble with it on exchanges that act without regulation forming a means to allow people in criminal groups to launder their ill-gotten gains. So post by post, I’m going to start talking about what is going to happen when I go to court. You see, in court, there is a procedure and a set of rules, people cannot rely on falsified information, and I can’t argue that I don’t want to say things because I’m embarrassed. So I gain in strength in a place like the court. There are many things I don’t want to talk about. There are the losses I’ve suffered and the fact that I have to admit that people stole money from me, the fact that I have to admit that people took my invention, did everything to stop what I was working on from being possible, and made it part of an ongoing system. I have to admit that the system I created that was honest and could be linked directly to know your customer systems to simplify compliance is being used to help criminals. But in court, it’s not the lies and the proof of social media that work; the laws of evidence work.