To be a valid hypothesis under the scientific method, there are steps that need to be followed. It is not simply enough to say that something is a theory; there are requirements that must exist before something can be called a theory in science.

The scientific method requires that several key fundamentals are addressed allowing something to act to increase knowledge.

1. Explanatory power

For every hypothesis or theory, there is a requirement that it explains the subject matter that it is addressing. A scientific theory or hypothesis will apply a minimum set of assumptions and should be falsifiable. It should be tested through methods of formal empiricism without needing justification through external calls such as a call to authority. In order to falsify a theory, we should have tested it, and if it does not pass the critical test, then it is considered falsified.

To investigate a number of fallacies that are considered to be theories by many in the Bitcoin community, we start by looking at selfish mining and block reordering (CTOR specifically).

- In selfish mining, does the theory explain anything? We have here a possible flaw, but why is it not exploited?

- In CTOR, does it act to explain something?

Selfish mining in particular seeks to explain Bitcoin using a mathematical model. Doing so in itself forms a hypothesis and not a theory. Before such a hypothesis is published, the authors would need to do testing against a null hypothesis of the existing state of Bitcoin. It is simpler than people believe: run up a number of nodes, and measure how they react. It is not particularly complex. It is not about testing a mathematical model against the mathematical model but rather testing against reality.

Unfortunately, it is something that has been completely ignored when it comes to Bitcoin. Those seeking to publish papers about the energy use, vulnerabilities, etc. seek an agenda first, and aimed to confuse people with seemingly scientific jargon that does not relate to the system being explained.

2. Predictive success

The next part of investigating whether a hypothesis is scientific is to see whether it produces greater predictive success than the existing belief structure. That is, does it enable us to understand the phenomena we wish to investigate? It provides a means of prospectively testing our theoretical understanding. If a theory has no predictive power, it has no use in science.

The point is critical; neither CTOR nor selfish mining had or have been tested with a result. In fact, both provide results that differ significantly from the behaviour of Bitcoin.

The selfish-mining scam was all about creating a reputation and showing off by a postmodernist quack trying to pose as a scientist. This is important to understand. To be a valid scientific hypothesis, the thesis proposed needs to be tested and demonstrate statistical results that align to the behaviour of the system being described. It is not simply a test of the mathematical model, it is a real test of the system.

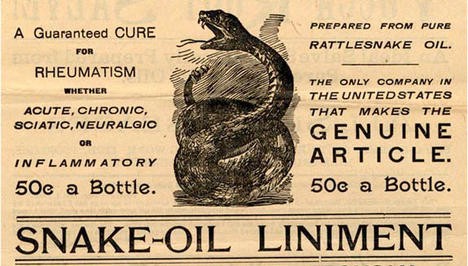

Saying “I do not want to create something others will exploit” is not how science works. It is how quacks and charlatans sell their snake oil.

When a scientific theory has been proposed and tested, even if it is not correct, the evidence produced when testing the hypotheses will be valuable. It is valuable because it still provides greater insight into the system. In the case of something like the completely unscientific claims of selfish mining, it is not only that there is no evidence; no evidence was ever sought.

Postmodernist pseudo science is still alive.

When we seek to evaluate a system scientifically, novel, unexpected behaviour is good. That would even help. Unexpected results provide insights that allow us to conduct further research.

3. The hypotheses allows control

We can use the results obtained by the hypothesis when it is valid scientifically. We gain something from the hypothesis describing a system as it allows us to predict the effects of changes such as growth and scale.

In Bitcoin, we would expect to be able to gain insecurity, to be able to scale further, and to understand the interactions of the system. But so was never the goal of the snake oil being peddled in things like selfish mining or CTOR.

Provably

It is why all the attacks against Bitcoin are worthless; they are all snake oil.

Not one of such systems has provided any testing. Not one of the so-called hypotheses and claims uses the existing system as the base and tests against the alternate. And doing so is important: to test the hypothesis and to create a valid scientific paper, the authors would have needed to test their claims against Bitcoin. In selfish mining, they would need to run up real nodes and test the system.

The process of hypothesis testing includes:

Step 1: State the null hypothesis (H0). Step 2: State the alternative hypothesis. Step 3: Set α. Step 4: Collect data. Step 5: Calculate a test statistic. Step 6: Construct rejection regions. Step 7: Based on steps 5 and 6, draw a conclusion about H0.

Bitcoin, as it was designed originally, is the null hypothesis. Always.

When it comes to something like selfish mining, step 2 would be:

- Can selfish miners gain a significant profit advantage exploiting the strategy. If they do, what are the consequences? Would it be easily detectable?

Alternatively, when investigating something like a proposed block-order change, we could investigate a question such as:

- Is CTOR faster than the default order in Bitcoin blocks? What are the consequences of changing the transaction order?

Or when investigating Lightning, we could have asked:

- Can you create a system (such as Lightning) that will be allowed in anti-money laundering (AML) law and at scale?

- Does it allow competition?

- Does it result in records being lost?

When it comes to all of the proposed changes, the scientific method looks to verification. Before making such changes, we should always ask the question, can it be verified? Then, we must remember to ask whether the hypothesis helps us:

- explain;

- predict; and

- control.

From there, a valid hypothesis can be the path to taking us into further knowledge, so we should ask whether we could then start a research programme to understand the issues: is the flaw detected and easily mitigated? Not, it is messy, and doing otherwise is prettier.

In Bitcoin, what is economically incentivised?

Like intelligent design, the pseudo-scientific quackery simply ignores explanations. They have an answer, no tests needed.

Here is where we are with the field of blockchain. People rarely test. Rather, they make claims such as, “We are better as we have scientist X or Y…”

Such is the false appeal to authority. It relies on an argument from ignorance.

Importantly, you cannot take one false theory to explain another (which is what happened with the claims of security flaws in Bitcoin as a result of transaction malleability).

All such claims are quantifiable

All of the so-called hypotheses concerning Bitcoin can be tested. Every one of the claims links to a measurable and quantifiable metric. When testing, we should be looking at:

- reliability;

- precision; and

- accuracy.

They are not the same, though some people confuse them. The first, reliability, relates to whether we can repeat the same results over and over in an experiment. It refers to an ability to have either or both position or/and accuracy stay within predictable bounds.

Precision is how true we are to the mark each time we make a risk measurement. In other words, we find how close to the real value we may lie on average, and in effect, it comes to the level of variance we have. We can actually be imprecise with the mean value right on the bullseye and results that have a large variance or spread. They would be centred around the expected mean on average but with results that vary widely.

Accuracy is how close we are to the mean or other value we see as the measure of risk. We can say it is a measure of how close we are to the bullseye.

To have a good measure of risk, we need to aim for both precision and accuracy. It is also important that we can reliably have a measurement that we can have others examine and produce.

Qualitative measures

Those who tell you that they cannot qualitatively measure the results of the system change are seeking to promote an agenda without evidence, which generally means they are seeking to avoid truth. To be scientific, research requires that we make predictions, and here, the ultimate test of such predictions is the result delivered by systems in the real world over time.

The next time somebody tries to tell you that Bitcoin needs to be fixed because transaction ordering using CTOR will be better, that selfish mining makes Bitcoin insecure, that malleability allows funds to be stolen, or any of the other associated myths and lies, remember that they need to test using empirical evidence or they are selling you snake oil.