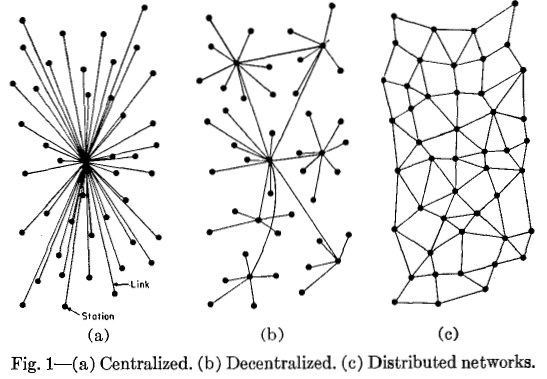

It is interesting how the arguments against commercial mining come down to an outcry against “mining centralisation.” All things in life come from balance. In the commonly used image listed as Fig. 1 below, we see what people like to have as a concept of Bitcoin. Unfortunately, it is also utterly wrong.

In the last few years, we have seen a rather socialistic push for mining equality and the move towards altering the proof-of-work algorithm with a goal of “punishing miners” to be more efficient. For example, we have recently seen ETH move to an ASIC-resistant (which means they have not figured out how yet) algorithm with a goal of making the network more equal — what some call “decentralised.” The catch cry for enforced “fairness:” equality in outcome through the redistribution of wealth from the most to the least efficient.

Simply put: no, it does not stop “centralisation.”

In fact, you cannot create a system in Bitcoin or any “blockchain” for that matter that is designed to deliver an outcome of equality. The primary purpose of Bitcoin is to create a system that is immune to such a form of redistribution at the monetary level.

If you have any sense, you start to understand that 100,000 machines in a data centre are ALWAYS more efficient, use less power, and win hands down when compared to 1000 people who are each running 100 machines. In both cases, we have the same total number of machines, but a data centre is more efficient. It uses far less power and resources, and it will cost far less.

In the original Bitcoin code, there was a simple calculation that related to the propagation of transactions. The reality is that only miners matter here. The transactions must get to miners, and no other system makes any difference.

In the paper “On Red Balloons and Bitcoin,” [1] the authors provide proof of the theorem saying: Suppose that H ≥ 3. There is no Sybil-proof reward scheme in which information propagation and no duplication are dominant strategy for all nodes at depth 3 or less. They go on to develop a Hybrid propagation scheme. The authors did not test the Bitcoin network and, as most do, assumed that it is a distributed mesh as we see in Fig. 1 [c]. In the chart, the distance is an average of d>5 for only a few hops and nodes.

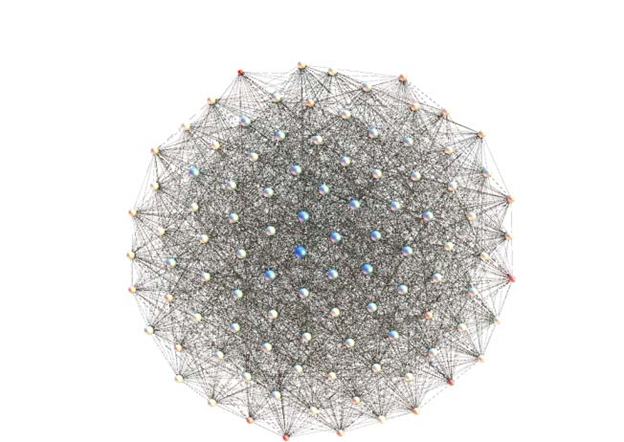

None of the researchers have studied Bitcoin enough to see that it is none of the ones in the chart, but rather it forms a small-world [2] network (Fig. 2). As such, as the hosts become more connected, they can come closer and closer to forming a semi-complete graph. If you read the original Bitcoin white paper, it is clearly and distinctly defined.

In a complete graph, all nodes are connected to each other. It precludes the use of small systems (such as Raspberry Pis), as the systems need to be able to efficiently send to many other systems at once. It is how Bitcoin was designed. Bitcoin nodes remember the IP addresses that they had previously connected to, and exchange node lists. Doing so means that they do not act as a pure random graph. Bitcoin nodes collect and remember other nodes.

As such, a more powerful system will always be able to handle a larger number of connections, and allows growth to a stage that is closer to a complete graph — improving efficiency, and rendering the network more secure.

In any of the networks in Fig. 1, the network is not secure, and can easily be “sybiled” or attacked. Even a distributed network can be attacked. Such an attack may have multiple paths, but a single well connected Sybil can then act as several nodes and delay or subvert transactional propagation.

The attack format from Sybils is not feasible in Bitcoin. No node can be too connected, and hence a Sybil in the idea with large well connected nodes always acts after the other parts of the network.

We see it as a competing epidemic model (Fig. 3). As a node receives a transaction, it is now immune from a competing transaction (such as a double spend or competing block).

We can use such ideas to model how a system functions, which has been a common area of research for decades in epidemiology.

We see the states in Bitcoin propagation diagrammatically in Fig. 5.

And it leads us to the fatal flaw in the equality camp by those seeking to punish others who create wealth through productivity and increased efficiency.

GPUs, CPUs, and a desire of many small systems

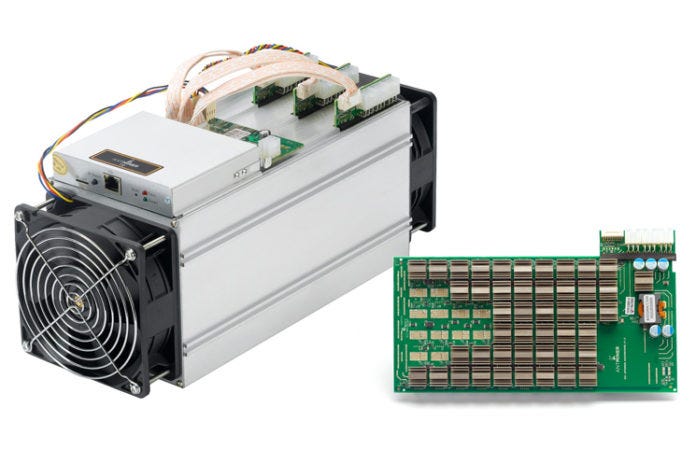

One problem with the aim to have a distributed network and not to allow the growth of connectivity is that it results in a less secure system. In research that I presented in 2011/2012, we demonstrated that the creation of criminal botnets is an economic function. A single modern ASIC system (Antminer S9) is equal in power to approximately 50,000 to 75,000 individual computers mining Bitcoin.

- A CPU has around 15 MHash of power (it ranges a lot with the power of the many chipsets).

- A GPU can obtain 750 MHash, again with variations and at low rates for many cards.

- The Antminer S9 has a hash rate of 12.93TH/s +- 7%. Such a rate is close to 1,000,000 times the power of a CPU, and still many times that of a GPU.

The result is that a single small farm of ASIC-based systems will outcompete even the biggest of criminal botnets.

Today’s post is just a quickly thrown-together one about some research we are conducting, but the truth is that Bitcoin scales best as it was designed — as system of competition between companies that seek to obtain the most efficient use of the power and equipment, and not a swarm of individuals who are less likely to care for the security of the network.

As was demonstrated in a 2010/2011 research publication, which is incorporated into chapter 6 of my thesis below, criminal behaviour can be modelled using predator/prey games.

If we make the system more expensive to attack, criminal groups rationally act to find other targets. In allowing GPU mining, Bitcoin becomes easy to attack. With botnets of up to 50 million compromised hosts in size, the reality is that Bitcoin is most secure when it is not based on home-user systems for mining.

Productivity

The main reason why no proof-of-work system can ever create an equal one-user-one-vote system is that it is not efficient.

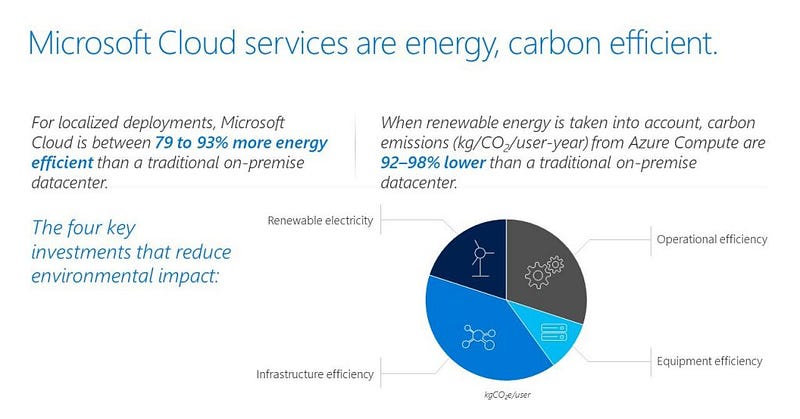

Microsoft’s new report The Carbon Benefits of Cloud Computing contrasts the energy consumption and environmental impact of running applications when comparing cloud-based corporate data centres to more traditional corporate systems. Microsoft demonstrate not only that the cloud offering is more carbon efficient (up to 98 percent better than on-premises), but that a data centre utilises between 22% to 93% lower energy consumption running standard enterprise workloads. Such applications are the ones which consume the most energy in Azure and offer low intensity when compared to Bitcoin and other mining-based systems.

The issue, as always, comes back to cost.

There is no proof-of-work solution that is not more efficient when scaled, and so was always the design.

References:

[1] Babaioff, M., Dobzinski, S., Oren, S., and Zohar, A. 2011. On Bitcoin and Red Balloons (full version). Available online: http://research.microsoft.com/apps/pubs/?id=156072q.

[2] http://mathworld.wolfram.com/SmallWorldNetwork.html

See also:

http://en.bitcoin.it/wiki/Non-specialized_hardware_comparison

http://ro.ecu.edu.au/cgi/viewcontent.cgi?article=1148&context=ism