George Akerlof did us a great disservice with his unscientific rhetoric. A market for lemons and other market failures seem plausible, but how about testing the hypothesis?

Testing using empirical data is the heart of science. Then so few economists are these days. We use econometric models that are terrible and that shame many of my colleagues in mathematics.

Akerlof’s paper was rejected for “triviality” by both the American Economic Review and The Review of Economic Studies, and yet it is seen as something special and drove a movement against markets. The Journal of Political Economy rejected the paper as incorrect and flawed. The argument was that if this paper was correct, then no goods could be traded. The empirical studies have ALL supported this. The hypothesis was flawed. All it was: a hypothesis and a flawed one at that.

When are we going to actually start acting scientifically — a hypothesis is not truth.

As stated, the effect WAS actually empirically tested. The most cited results come from:

Hoffer, George E.; Pratt, Michael D. (1987). “Used vehicles, lemons markets, and Used Car Rules: Some empirical evidence”. Journal of Consumer Policy 10 (4): 409–414. doi:10.1007/BF00411482.

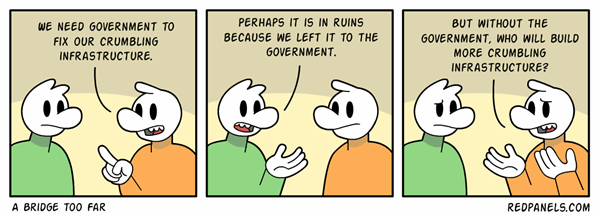

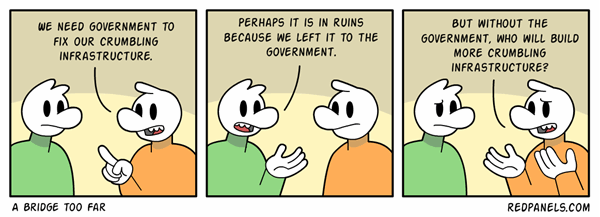

“When market participants have the incentive to exchange, they also have the incentive to create institutional mechanisms to facilitate that exchange. The failure to recognize and appreciate these private mechanisms for overcoming asymmetric information — not the failure of actual markets — is often what leads to mistaken calls for government regulation.”

J. Hall (2007) “Uneven Information Causes Market Failure? It Just Ain’t So!” FEE

Market failure, sorry, government failure!