Central governments are and remain a net supplier of macroeconomic instability. This is a direct result of the institutions and policy tools created to conform to a Keynesian vision. These are now a fundamental portion of our economic and political environs.

For Keynesians, the complete commercial sector is questioned in the position of only two classes of goods:

1. consumption goods and 2. investment goods.

It is simple of course to ignore the distributions of prices within these two classes. Having studied Bayesian statistics and having my masters in statistics with respect to the problem of homogeneity of variance measurements, I can state that this is a huge flaw. Comparing two means with similar values but hugely different variances is a mathematical and logical flaw — one Keynes decided to overlook when it was noted by Hayek.

The shoddier logic than this from Keynes comes from price equilibria; here one relative price that is engaged in this formulation. This involves the relative value of consumer goods with respect to investment goods as articulated by the interest rate. This calculation is based on an assumption where it can either not function and fail or function aberrantly — an assumption not based on quantitative data available even at the time.

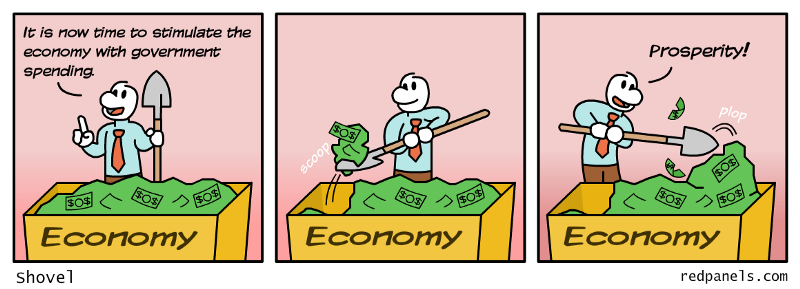

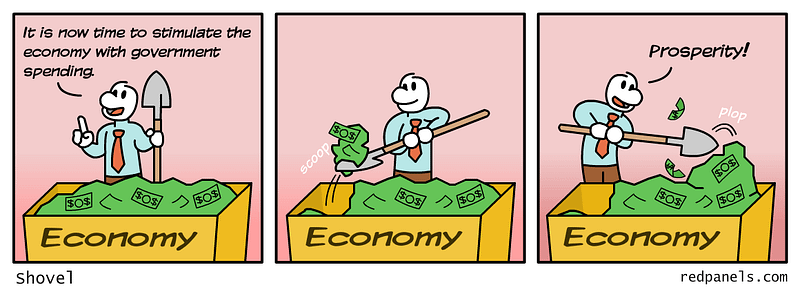

Of course, the notion of scarcity is missing from Keyne’s philosophy. The trade-off between generating consumption goods and constructing investment goods is an often overlooked foundation of reality. We have limits. We can only do one thing, at the expense of another. In all cases, the manufacture of a greater amount of plant and equipment — capital ALWAYS has to be facilitated through an increase in net savings. These savings are obtained through a decrease in current consumption. The US has lived on the savings of other nations for many years through a Fed policy of unnaturally low interest rates. There is always a need to pay the piper eventually.

Keynesian aggregates serve to conceal these very mechanisms. Keynes simply swept away the impression of any trade-off between consumption and investment. The problem is, though, his formulation was elegant, it had little correlation to reality. We live in a universe of limits. Like it or not, all things are made at the expense of an alternative. Liberal views that ALL PEOPLE SHOULD HAVE EVERYTHING MEAN LITTLE; THERE ARE LIMITS AND NO AMOUNT OF POLITICAL HOT AIR CAN ALTER THIS FACT. Welcome to the real world.

William H. Hutt, when calling the theory a “theory of idle resources”, and F. A. Hayek, in stating the underlying foundation of Keynesian-ism to be an “economics of abundance”, hit the nail on the head. The problem is not a world of abundance, but one of scarcity. This is the foundation of economics.

The set of reciprocally supporting but mutually unsupportable proposals concerning the relationship of how selected macroeconomic aggregates are related to one another is unsupported in reality for all the elegance of the theory. Keynesian policy is this set of self-justifying policy prescriptions.