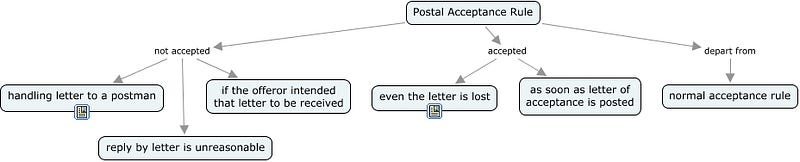

The postal acceptance rule states that where an acceptance is to be sent by post, the contract associated with that acceptance is considered as concluded at the moment of posting the letter, not when the letter is received (or in fact if the letter is received). If the offeror does not wish to conclude the contract through acceptance via the post, s/he may stipulate the form of acceptance. (The “postal acceptance rule” was introduced to present assurance to the “new” British penny post. It dates back to Adams v. Lindsell, 1 Barnewall and Alderson 681, In the King’s Bench (1818); see also Household Fire Insurance Co v Grant [1879] 4 Ex D 216).

Lim (2004) points out that there have been at least “twelve theories or explanations offered for the postal acceptance rule”. He further notes that two of these theories apply particularly well to Internet-based contractual transactions. The first theory hypothesises that the postal acceptance rule is applicable to Internet transactions as the communication proceeds through a third party. Next, an argument exists for the theory that the postal acceptance rule applies to e-mail, as it is a non-instantaneous means of communicating. Bitcoin is non-instantaneous, but, the mining system that verifies transactions can be seen to act as the third party when an exchange is not conducted directly or in person.

Contractual acceptance through e-mail has been settled by judicial review and decision. As such, the high degree of uncertainty surrounding the issues of offer and acceptance related to the formation of contracts through e-mail-based communication is long past. In the US, this issue has been determined through statutory intervention (Uniform Electronic Transactions Act, 1999; USA). In the UK, the issue remains clear following the ECA. For this post, I will assert that the exchange of a transaction and payment for settlement and exchange using Bitcoin mirror that postal acceptance rule in e-mail.

Even when we start to look to exchanges using Bitcoin, cases concerning international transactions allow the Sale of Goods (United Nations Convention) Act 1994 to be applied. This act overrides the concept of “postal acceptance” and is an alternative that presents the approach that acceptance “will become effective at the moment the indication of consent reaches the offeror”. In practice, the acceptance transpires at the instant that the communication arrives at the offeror’s Bitcoin address, and this is when it is accepted into the Blockchain. While no decided cases concerning Bitcoin are published as guidance, the courts have traditionally been disinclined to extend the application of the postal acceptance rule. That said, we can easily show how the exchange of Bitcoin and EDI are analogous.

Although telex, faxes, e-mail, and now Bitcoin are separate technologies, they share many features. In both Entores v. Miles Far East Corp ([1955] 2 QB 327) and Brinkibon Ltd v Stahag Stahl (1983) the courts declined to extend the application of the postal acceptance rules. The nature of contractual exchange in Bitcoin would allow the same acceptance rules to be accepted by a court in the UK.

Lord Wilberforce (Brinkibon Ltd v Stahag Stahl [1983]) stated at 42, “where the condition of simultaneity is met, and where it appears to be within the mutual intention of the parties that contractual exchanges should take place in this way, I think it a sound rule, but not necessarily a universal rule”. The issue of “read receipts” for e-mail could be an important factor in a future decision. Lord Fraser of Tullybelton (at 43) differs somewhat in his judgement from Lord Wilberforce, saying that:

A party (the acceptor) who tries to send a message by telex can generally tell if his message has not been received on the other party’s (the offeror’s) machine, whereas the offeror, of course, will not know if an unsuccessful attempt has been made to send an acceptance to him. It is therefore convenient that the acceptor, being in the better position, should have the responsibility of ensuring that his message is received.

From the above cases, we can see technological differences such as the inclusion of read and sent receipts. In the last two decades, we have moved from the formerly arguable position of e-mail as to whether it is or is not “instantaneous” and the associated level of uncertainty in contracting as “the question of the applicability of the postal acceptance rule to e-mail acceptances has not been judicially settled” (Lim, 2002, p66) to one of common practice. In extension, the issue to be considered is whether delivery to the blockchain itself is an acceptance under the existing framework.

The postal acceptance rule as a general consideration does not apply to web-based communications. This is because most web-based systems employ mechanisms such as check-sums to maintain constant communication between the client and server systems. The constant verification of this communication channel provides for the implication that communications take place through an immediate send process. Thus, both parties receive communications (near) instantaneously.

Bitcoin differs from the web in that the sender and receiver of the transaction may act in different time periods. The sender may send, and the recipient check at vastly different times, even though a transaction is stored in the Bitcoin blockchain immutably. The issue to be decided is the moment of receipt. This should not be when a recipient checks that a transaction has been sent to their address nor even that it is in a block as this would be analogous to a recipient not accepting a letter until the letter box was opened.

As fast as it is, Bitcoin is not instant. As stated in the Bitcoin white paper, “messages are broadcast on a best effort basis”. The result is that we can see Bitcoin as a form of transactional contracting that is analogous to email and not the web.

The sender can see that the transaction is complete and even that it is included into a block, they cannot tell when the recipient has accepted this, unless they see the transaction spent. So, it is clear that the onus of acceptance here mirrors the postal acceptance rule in structure.

The UK government has adopted the Model Law (as contained in the Electronic Commerce (EC Directive) Regulations 2002, SI 2002/2013), which has put to rest the postal rule argument concerning email. The regulations unmistakably declare the point at which an order is legally supposed to be communicated. Regulation 11(2)(a) states that in an exchange of a businesses contract, “the order and the acknowledgement of receipt will be deemed to be received when the parties to whom they are addressed are able to access them”. Where contracts complete by email are concerned, the instant of completion would be the time when the email is presented to the person to whom it is addressed and not when the message is actually received by their email server.

Likewise, it is the delivery and transfer of a Bitcoin transaction to a mining node and not the accessing of that transaction in a wallet that marks the point of acceptance.

There are exceptions. In this post we looked at the exchange of terms and acceptance remotely. If parties deal in person and hand a transaction to one another, the use of the postal acceptance rule would naturally not apply.

Reference:

Lim, Yee Fen (2002) “Cyberspace Law, Commentaries and Materials”, Oxford University Press UK, ED 2004