The security industry and criminal activity feeds upon itself. Crime and entrepreneurship each create opportunities for the other. In this, new innovations are created allowing both the growth of new forms of criminal activity as well as the ensuing opportunities for alert security professionals.

Markets spawn their counter. That is, criminal markets spawn new forms of counter and in turn, each of these are reactive as well as proactively introducing new opportunities. So, each security improvement creates a new form of criminal activity and the growth of new criminal groups leads to a fresh set of entrepreneurial risk and security firms that are better aligned to meet the changing challenges and problems posed by a new form for criminal action arise to fill this newly created dislocation.

Where criminal “innovation” is lax, generally due to the failure of the criminal organisation to extract sufficient profit for the level of risk they are exposed to, innovation may be driven down.

Hence, increases in the risk associated with crime or the generally deficient conditions in a black market and the associated reduction in profitability lead to reduced incentives to create new forms of crime and the incumbent players (criminal groups) will entrench and act to protect their existing market share.

Any time where a set of concurrent disequilibria has come from the result of innovation, opportunities inevitably result. This is true for both the legitimate market as well as that of a black or criminal market.

In long term states of relatively low disequilibria, all societies stagnate. This is equally true of crime and in these events the condition leads to a form of entrenchment and lethargy.

However, the introduction of disequilibria comes from many sources and the introduction of innovation into markets creates a corresponding round of opportunities in associated markets including those we seek to minimise such as criminal ones.

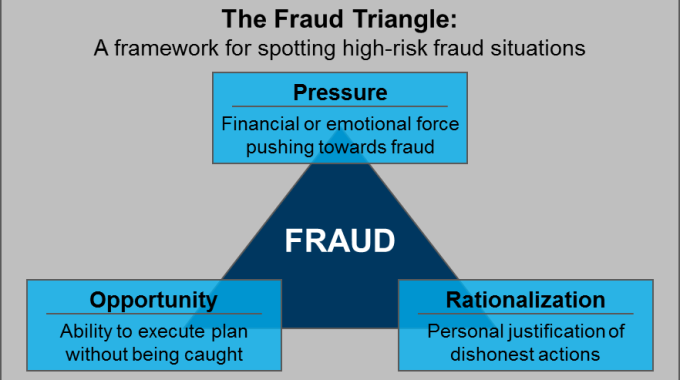

Basically, what is being said in this — risk matters. No system is ever perfect. No system can be made to be perfect. What we need to do is no more than to ensure that a system is not economically viable to be exploited. In a scenario such as Bitcoin, we do not need to find a “Fix” for 0-conf, it is already secure enough. We only need to ensure that we understand the risk we face.

Bitcoin is a commercial system. It is money. When we start to understand that, we can start to see that risk can be best mitigated not by altering the system, but in the creation of the best responses to risk. Some risk will be mitigated, some shall be accepted. This is the nature of risk.