The following is why you do not pay VAT or GST on Bitcoin.

In January 2014, the Australian government argued that GST should apply to Bitcoin. With the help of Clayton Utz and a senior partner of the law firm, I applied for an offset based on the strange scenario of having GST on money.

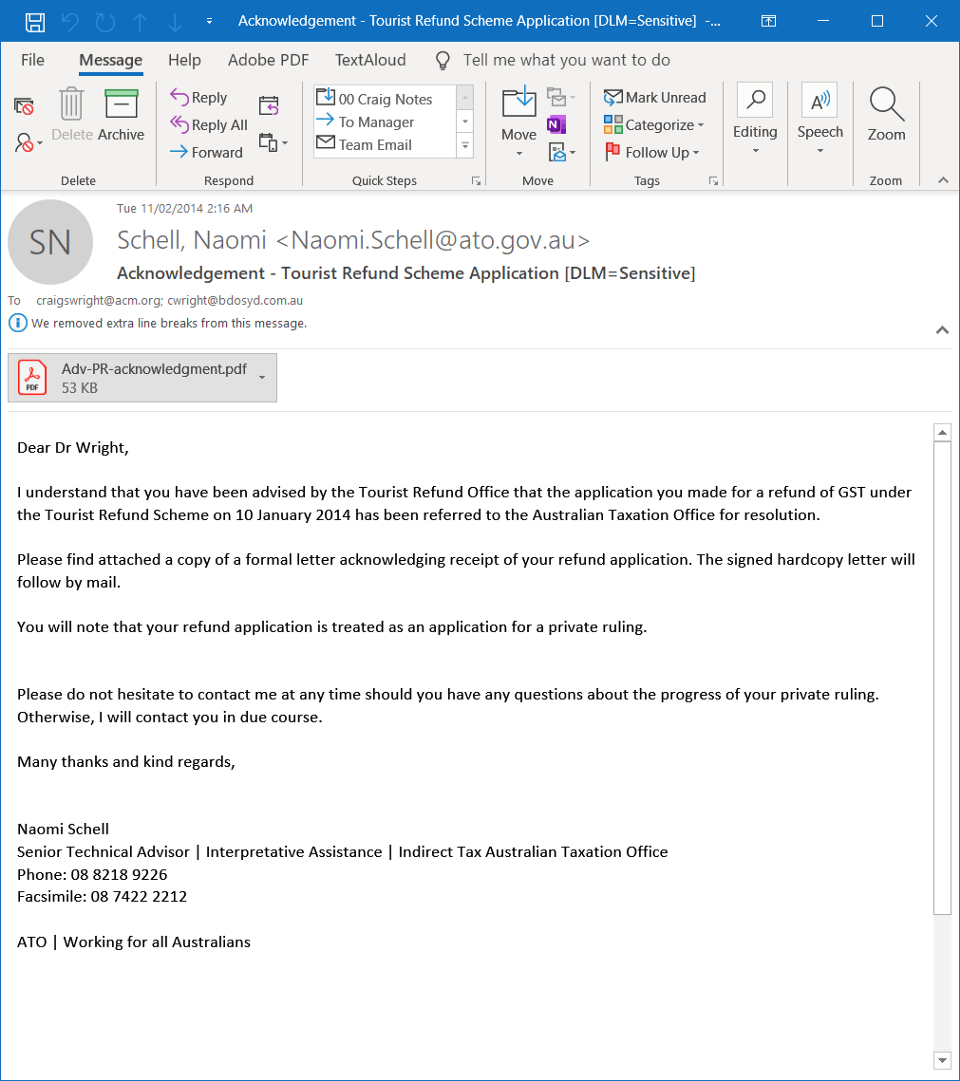

There is a refund system called the Tourist Refund Scheme.

I took around 31,000 XBT, which was valued at around AU$30 million, and used the private ruling system to force the government into making a decision as to how they would treat Bitcoin and to show them that placing GST on money was rather insane. It was a two-step process. I put a purchase order in to buy the bitcoin from overseas. It resulted in a $3 million goods-and-services liability. I then took the money out of the country and into Singapore, which was done within 24 hours, and as a result exchange-fluctuation effects were negligible. Moving the money out of the country resulted in a GST claim totalling $3 million. With the price fluctuation and other aspects, it resulted in what would have been a net loss of around $50,000 for myself personally. Which doesn’t include the cost of travelling to and from Singapore to do so.

1. On 10 January 2014, you made a claim under the Tourist Refund Scheme (TRS) for your acquisition of rights to a Bitcoin wallet, from Hotwire Pre-Emptive Intelligence Pty Ltd (Hotwire).

It was a rather surreal experience; the poor guy at the counter of the tourist refund centre did not know what to do. The computer had a field in the database that had a maximum value of $9,999,999.99, and he could not enter the amount that I was taking. The purpose of such an exercise was not to get a refund. It worked exactly as I’d hoped. It’s not always good to poke a bear, but it needed to be done; the imposition of GST on Bitcoin was ridiculous.

The public-ruling database of the Australian Taxation Office (ATO) has the anonymised version of my claim. In looking at it, the tax office quickly realised how easy it would be to abuse the GST system if GST was applied to Bitcoin. Which was of course the point I was trying to make. Unfortunately at the time, I was a rather brash individual, and rather than allowing my lawyers to deal with the matter correctly, I pulled such a little stunt to force their hand. It did. It was very quickly considered and rejected out of hand. The invoice leading to a debt was reversed, and had to be re-entered without GST. So effectively, I bought and sold bitcoin to myself over the border, and the result was that the Australian government rejected imposing GST on Bitcoin. In 2013, we had been discussing the same matter in roundtables and at conferences. I’d met with commissioners and the deputies, and we had been getting nowhere. It was actually looking as if they would impose GST. Rather than spending years trying to focus an effort, I chose the quickest and nastiest way of making them see just how foolish such a thing would be.

So no, there are matching invoices for the negative and positive, and there was nothing in my advantage as a result. All up, the exercise cost me around AU$50,000. So, for all of you have used bitcoin between 2014 and 2017, the fact that you haven’t been paying GST on it is something you can thank me for.

The people in the tax office were not appreciative. Some of them felt that I’d been making a fool of them, which was not my intention; rather it was just to get them to see how foolish GST on money would be.

Research and Development Tax Incentives

To debunk another myth, in the Australian 2014–2015 tax year, we had a group of companies who together had a turnover in the order of far more than the Australian government allows for rebates.

Unfortunately, and as a result of many seeking to defame me, some failed to understand the distinction between the offset and the rebate of R&D tax purposes. Back before it was publicised that machines I was running also handled gaming operations, SGI had been happy to be a part of everything. You see, US law precludes companies such as SGI from selling to organisations that are involved with Internet gaming. They have export-license restrictions — which can be bypassed using grey-market sales techniques. Then, large companies like SGI don’t like to be associated with such publicly.

What people fail to understand is that a turnover that would be large enough to obtain a tax rebate of more than $20 million means that you are not eligible for the offset. You do not receive a direct cash payment, but are able to offset other taxable income.

In my case, I would have been able to make a sale of bitcoin and intellectual property assets and use the deduction to offset the amount. As such, I could have made a foreign sale of $20 million, and instead of having an associated corporate tax bill of $8 million in the company and a capital gain of $10.5 million, I would have been able to utilise the offset to sell bitcoin and other assets and minimise the amount of tax I had to pay. Effectively, if I’d sold bitcoin and bought assets back into Australia, the tax regime at the time would have left me with $1.5 million in cash for a $20 million sale. So for those who don’t like to think, what you will find out is that there was never any money coming back from the Australian government. Using the R&D tax scheme would have enabled my company to have continued within Australia rather than having to move to Europe. But, Internet trolls really like to check facts.